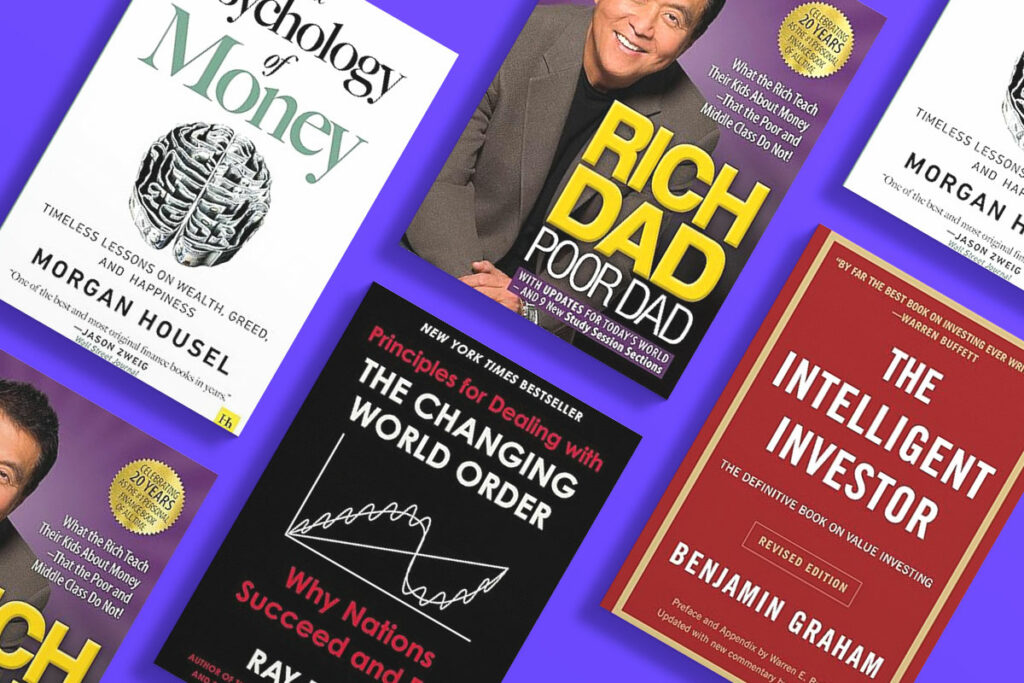

Staying informed about personal finance, investing, and economic trends is crucial for financial success. Reading the right books can provide valuable insights and strategies to manage your money effectively, grow your wealth, and achieve financial independence. As we step into 2024, here are some of the best financial books to read that offer timeless wisdom and cutting-edge advice.

1. “The Psychology of Money” by Morgan Housel

Overview:

Morgan Housel’s “The Psychology of Money” delves into the behavioral aspects of finance, exploring how emotions and psychological factors influence financial decisions. The book emphasizes that managing money isn’t just about what you know but also about how you behave.

Key Takeaways:

- The importance of understanding your own financial behavior.

- Why patience and self-control are crucial for financial success.

- Stories and insights from real-life financial decisions and mistakes.

Why Read It in 2024?

With the ever-changing economic landscape, understanding the psychological factors that drive financial decisions can help you navigate uncertainty and make better choices. Housel’s insights into human behavior provide a deep understanding of why we make the financial choices we do, which is essential in a world where markets are increasingly volatile and unpredictable.

2. “Principles for Dealing with the Changing World Order” by Ray Dalio

Overview:

In this book, Ray Dalio, the founder of Bridgewater Associates, examines the historical patterns that have shaped the rise and fall of empires and economies. He provides a framework for understanding current global financial trends and predicting future economic shifts.

Key Takeaways:

- Historical parallels and patterns in economic cycles.

- How to anticipate and prepare for major economic changes.

- Insights into the future of global markets and economies.

Why Read It in 2024?

As the world grapples with geopolitical tensions and economic volatility, Dalio’s insights can help you understand the broader trends and position your finances accordingly. The historical context provided by Dalio helps readers see the big picture and prepare for potential economic upheavals.

3. “The Intelligent Investor” by Benjamin Graham

Overview:

Originally published in 1949, Benjamin Graham’s “The Intelligent Investor” remains a cornerstone of value investing. The book offers timeless principles for long-term investment success and emphasizes the importance of disciplined investing.

Key Takeaways:

- The principles of value investing and margin of safety.

- The difference between investing and speculating.

- How to develop a rational investment strategy.

Why Read It in 2024?

In a market characterized by rapid changes and speculative trends, Graham’s conservative approach to investing can provide stability and long-term growth. His teachings on the importance of thorough analysis and disciplined investing are more relevant than ever in today’s volatile market environment.

4. “Rich Dad Poor Dad” by Robert T. Kiyosaki

Overview:

“Rich Dad Poor Dad” is a personal finance classic that contrasts the financial philosophies of Kiyosaki’s two fathers: his biological father (Poor Dad) and his best friend’s father (Rich Dad). The book challenges conventional wisdom about money and highlights the importance of financial education.

Key Takeaways:

- The difference between assets and liabilities.

- The importance of financial literacy and entrepreneurship.

- How to think like an investor and build wealth through smart investments.

Why Read It in 2024?

Kiyosaki’s practical advice on building wealth and financial independence remains relevant, especially for those looking to rethink their approach to money. His emphasis on financial education and smart investing is crucial in an era where traditional financial advice may no longer be sufficient.

5. “Your Money or Your Life” by Vicki Robin and Joe Dominguez

Overview:

“Your Money or Your Life” offers a transformative approach to personal finance, focusing on the relationship between money and life satisfaction. The book provides a nine-step program for achieving financial independence and living a fulfilling life.

Key Takeaways:

- How to track and evaluate your spending habits.

- The concept of “enough” and finding financial contentment.

- Strategies for reducing expenses and increasing savings.

Why Read It in 2024?

In a world where consumerism and lifestyle inflation are rampant, this book’s emphasis on mindful spending and financial independence is more relevant than ever. Robin and Dominguez’s approach to evaluating the true cost of your spending can lead to a more satisfying and balanced financial life.

6. “The Millionaire Next Door” by Thomas J. Stanley and William D. Danko

Overview:

Based on extensive research, “The Millionaire Next Door” explores the habits and traits of America’s wealthy individuals. The authors reveal that many millionaires live modestly and prioritize saving and investing over conspicuous consumption.

Key Takeaways:

- The common traits and behaviors of self-made millionaires.

- The importance of frugality, discipline, and planning.

- How to build wealth over time through consistent savings and investments.

Why Read It in 2024?

Understanding the habits of the wealthy can inspire you to adopt similar practices and build a solid financial foundation. This book debunks the myth that wealth is about high income and lavish spending, showing that true wealth often comes from living below your means.

7. “I Will Teach You to Be Rich” by Ramit Sethi

Overview:

Ramit Sethi’s “I Will Teach You to Be Rich” is a practical guide to managing personal finances, from budgeting and saving to investing and spending wisely. The book provides actionable advice and a six-week program to achieve financial success.

Key Takeaways:

- How to automate your finances for efficiency and growth.

- Strategies for paying off debt and building credit.

- Tips for investing in the stock market and retirement accounts.

Why Read It in 2024?

Sethi’s no-nonsense approach and practical tips are perfect for anyone looking to take control of their finances and build wealth systematically. His focus on automation and practical steps makes financial management accessible to everyone, regardless of their financial background.

8. “The Simple Path to Wealth” by JL Collins

Overview:

JL Collins’ “The Simple Path to Wealth” simplifies the complexities of investing and provides straightforward advice for achieving financial independence. The book covers everything from the basics of investing to advanced strategies for building a secure financial future.

Key Takeaways:

- The benefits of index fund investing.

- How to build and maintain a low-cost, diversified portfolio.

- Strategies for achieving financial independence and early retirement.

Why Read It in 2024?

With financial markets becoming increasingly complex, Collins’ simple and effective investment strategies can help you stay on track towards financial independence. His straightforward advice is particularly useful for those who feel overwhelmed by the myriad of investment options available today.

9. “Financial Freedom” by Grant Sabatier

Overview:

“Financial Freedom” by Grant Sabatier is a comprehensive guide to achieving financial independence as quickly as possible. Sabatier shares his journey from being broke to becoming a millionaire in five years, offering practical advice and strategies along the way.

Key Takeaways:

- How to increase your income through side hustles and smart investments.

- The importance of aggressive saving and investing.

- Tips for optimizing your lifestyle to achieve financial freedom faster.

Why Read It in 2024?

For those looking to fast-track their journey to financial independence, Sabatier’s strategies and real-life examples provide valuable inspiration and guidance. His focus on rapid wealth-building techniques is ideal for those who want to achieve financial freedom sooner rather than later.

10. “The Barefoot Investor” by Scott Pape

Overview:

Scott Pape’s “The Barefoot Investor” offers a simple, step-by-step approach to managing money and achieving financial security. The book is known for its practical advice and easy-to-follow strategies.

Key Takeaways:

- The importance of setting up a foolproof financial system.

- Strategies for paying off debt and building an emergency fund.

- Tips for investing wisely and building long-term wealth.

Why Read It in 2024?

Pape’s straightforward advice and actionable steps are perfect for anyone looking to simplify their finances and build a secure financial future. His emphasis on practical, no-nonsense strategies makes financial management accessible to everyone.

Honorable Mentions

While the above books are essential reads for 2024, several other notable titles deserve mention:

- “Broke Millennial Talks Money” by Erin Lowry: A practical guide for young adults navigating financial challenges and building a solid financial foundation. Lowry’s conversational style makes complex financial concepts easy to understand and apply.

- “The Total Money Makeover” by Dave Ramsey: A step-by-step plan for financial fitness, focusing on budgeting, debt reduction, and wealth building. Ramsey’s no-debt philosophy and baby steps program have helped millions achieve financial stability.

- “The Little Book of Common Sense Investing” by John C. Bogle: A guide to passive investing through index funds, written by the founder of Vanguard. Bogle’s emphasis on low-cost investing and long-term strategies is essential for those looking to build wealth without falling into the trap of high fees and active trading.

- “Financial Feminist” by Tori Dunlap: An empowering guide to financial independence and wealth-building for women. Dunlap addresses the unique financial challenges women face and provides actionable steps to overcome them and build wealth.

- “Think and Grow Rich” by Napoleon Hill: A classic that provides timeless principles for personal and financial success. Hill’s exploration of desire, faith, and persistence continues to inspire readers to achieve their financial and personal goals.

How to Make the Most of Financial Books

Reading financial books is a great start, but applying the knowledge is what truly

makes a difference. Here are some tips to help you implement what you learn:

- Take Notes: As you read, jot down key takeaways, strategies, and action steps. This will help reinforce your learning and make it easier to reference later.

- Set Goals: Identify specific financial goals you want to achieve based on the insights from the books. Break these goals into actionable steps and set deadlines to keep yourself accountable.

- Create a Plan: Develop a comprehensive financial plan that incorporates the principles and strategies you’ve learned. This plan should include budgeting, saving, investing, and debt management.

- Monitor Progress: Regularly review your financial plan and track your progress towards your goals. Adjust your strategies as needed to stay on course.

- Stay Informed: The financial landscape is always changing, so continue reading and learning. Stay updated with the latest financial news, trends, and books to keep your knowledge current.

Conclusion

Reading the right financial books can equip you with the knowledge and strategies needed to achieve financial success in 2024 and beyond. Whether you’re looking to master the basics of personal finance, delve into advanced investing strategies, or find inspiration for your financial journey, these books offer valuable insights and practical advice. Stay informed, take control of your finances, and work towards a secure and prosperous future.

For more insights and summaries of top financial books, explore BookBits Audiobook Summaries. Access concise summaries of the best financial books to stay informed and make smarter financial decisions.